Alegerea dispozitivelor: ce înseamnă cu adevărat „eco”

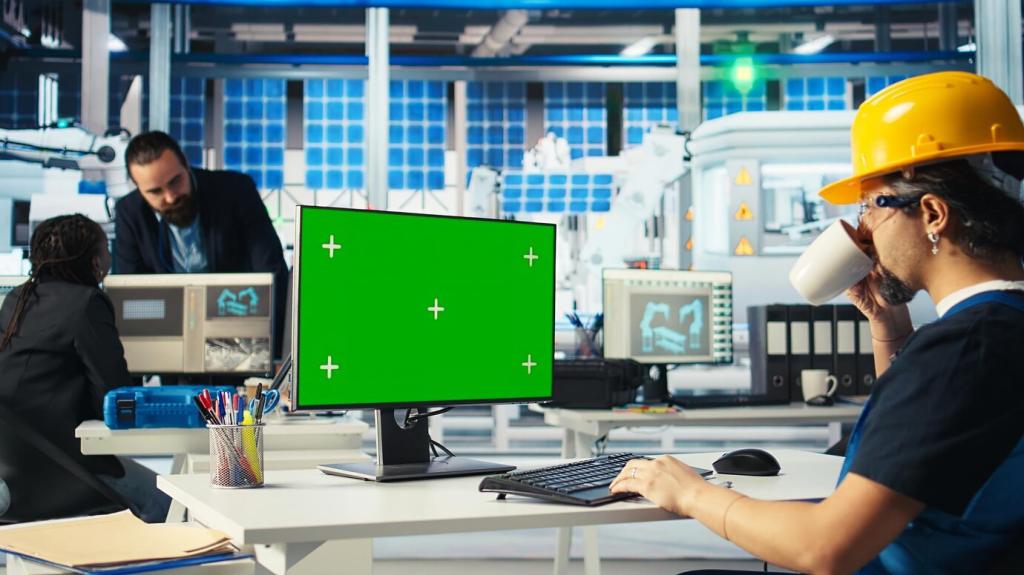

Prizele și hub-urile eficiente au sub 0,5 W consum în repaus. Diferența pare mică, dar în timp, la nivel de locuință, se adună economii notabile și o amprentă de carbon considerabil mai mică.

Alegerea dispozitivelor: ce înseamnă cu adevărat „eco”

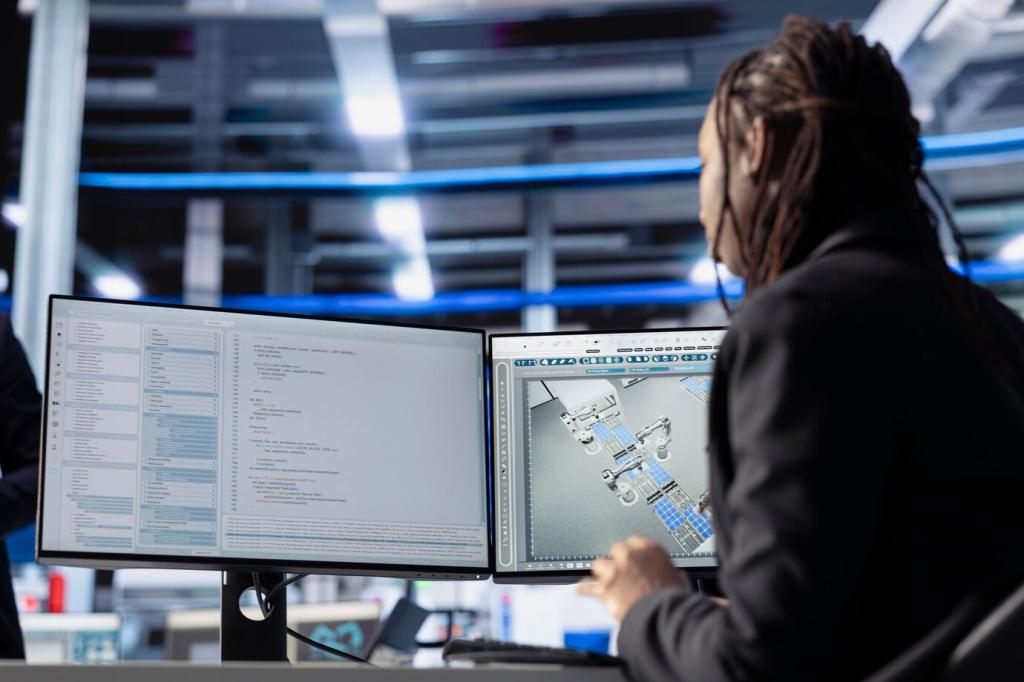

Standardul Matter și protocoalele eficiente, precum Thread, reduc necesarul de punți multiple și sporul de consum. Mai puține dispozitive auxiliare înseamnă mai puțină energie risipită și configurare mai simplă pentru utilizatori.

Alegerea dispozitivelor: ce înseamnă cu adevărat „eco”

Alege produse cu carcase reciclabile, manuale digitale și ambalaje minimizate. Întreabă brandul despre programe de reciclare și actualizări de firmware pe termen lung, apoi distribuie răspunsurile comunității noastre.

Alegerea dispozitivelor: ce înseamnă cu adevărat „eco”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.